Latency Arbitrage Trading in Forex: A Stable Source of Returns

Latency arbitrage trading is a sophisticated strategy employed in the foreign exchange (forex) market, leveraging discrepancies in the speed of price feeds between different trading platforms. This strategy capitalizes on the time delay, or latency, between the arrival of price information at one trading venue compared to another. By trading on a faster price feed and executing trades on a slower one, latency arbitrageurs can exploit these inefficiencies to generate consistent profits. This article explores how latency arbitrage works, its advantages, and its future in the forex market.

How Latency Arbitrage Works

In the forex market, currency pairs are traded across multiple platforms and liquidity providers. Each platform may have slight differences in the speed at which they receive and process price data. Latency arbitrageurs use high-frequency trading (HFT) algorithms to detect these discrepancies. By connecting to a faster price feed, they can identify price movements before they are reflected on slower platforms. When a price discrepancy is detected, the arbitrageur simultaneously buys the currency pair on the slower platform and sells it on the faster one, locking in a risk-free profit.

For example, if the EUR/USD pair is quoted at 1.1000 on a faster platform but still at 1.0998 on a slower one, the arbitrageur can buy at 1.0998 and sell at 1.1000, earning a small but risk-free profit. This process is repeated thousands of times per second, amplifying the gains.

Advantages of Latency Arbitrage

- Risk-Free Profits: Since trades are executed simultaneously, latency arbitrage is considered a risk-free strategy. The profit is locked in as soon as the trade is executed, regardless of subsequent market movements.

- High Frequency: The strategy relies on executing a large number of trades in a short period, allowing for significant profit accumulation over time.

- Market Neutrality: Latency arbitrage is not dependent on market direction. It profits from inefficiencies rather than market trends, making it a stable source of returns even in volatile markets.

- Low Capital Requirement: Due to the high frequency of trades, even small price discrepancies can lead to substantial profits, reducing the need for large capital investments.

The Future of Latency Arbitrage

As technology continues to advance, the forex market is becoming increasingly efficient. However, latency arbitrage is likely to remain relevant for several reasons:

- Technological Advancements: While faster internet speeds and improved trading algorithms reduce latency, they also create new opportunities for arbitrageurs who can stay ahead of the curve.

- Fragmented Market: The forex market is highly fragmented, with multiple liquidity providers and trading platforms. This fragmentation ensures that price discrepancies will continue to exist, albeit in smaller magnitudes.

- Regulatory Environment: As regulators focus on market fairness and transparency, latency arbitrage may face increased scrutiny. However, it is unlikely to be eliminated entirely, as it contributes to market efficiency by narrowing price discrepancies.

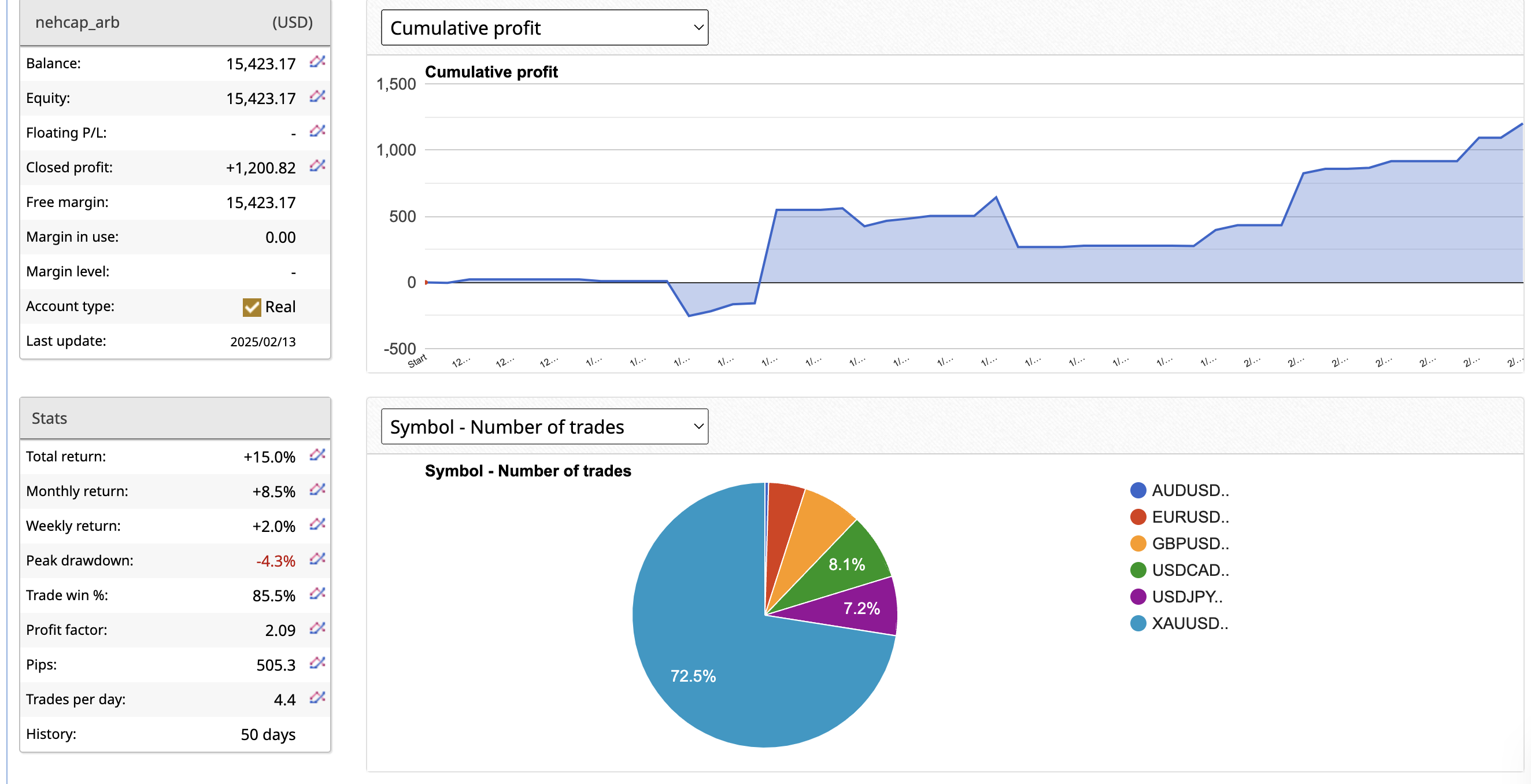

Nehcap Latency arbitrage system

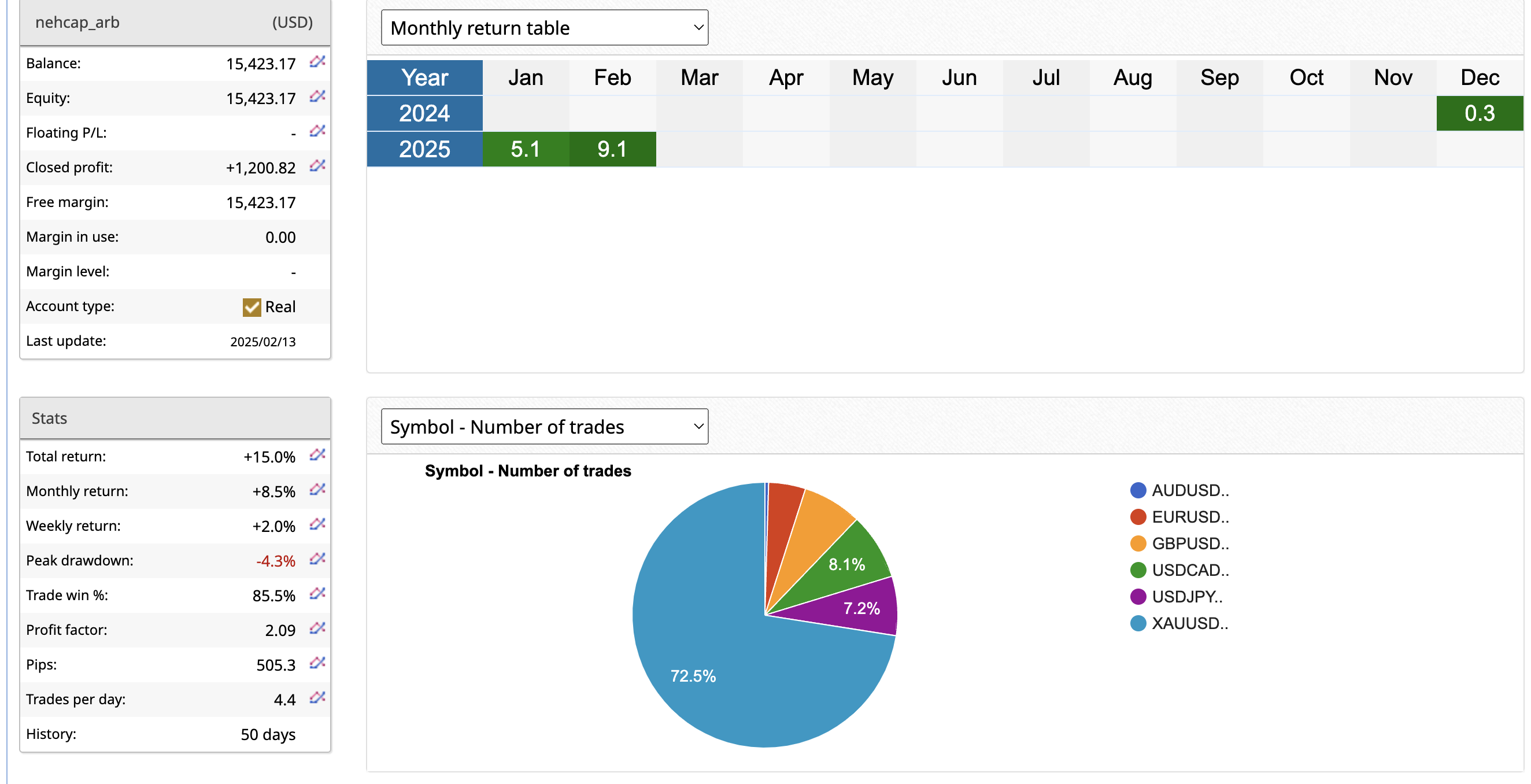

The system has been solid and stable. The monthly returns are shown below.

The monthly returns

As you can see its a stable system with active trading against a fast price feed. The system has made +9.1% this month. If you would like to join this system, read the details and pricing: LATENCY ARBITRAGE SYSTEM

In conclusion, latency arbitrage trading in forex is a sophisticated and highly effective strategy that leverages technological advancements to exploit market inefficiencies. Its risk-free nature, high frequency, and market neutrality make it a stable source of returns, ensuring its relevance in the future of forex trading.