Introduction

In the ever-evolving world of financial trading, where speed and efficiency are paramount, high-frequency trading (HFT) in dark pools within low latency networks has become a focal point. The Financial Information eXchange (FIX) protocol is central to these operations, serving as the backbone of communication in these high-speed, high-stakes environments. This blog post will explore the intricate relationship between the FIX protocol, dark pools, and high-frequency trading, all within the context of low latency networks.

Understanding the FIX Protocol

The FIX protocol, or Financial Information eXchange protocol, is a standardized messaging protocol developed for real-time electronic communication in the financial markets. Initially introduced in 1992, FIX has evolved into the global standard for trading, supporting a broad spectrum of financial instruments, including equities, fixed income, derivatives, and foreign exchange.

FIX’s flexibility, extensibility, and ability to standardize complex trading operations make it indispensable in modern trading environments. Its role in facilitating fast, accurate, and reliable communication between trading entities is crucial for the functioning of high-frequency trading systems and dark pools.

High-Frequency Trading: A Race Against Time

High-frequency trading (HFT) involves the execution of large volumes of trades at extremely high speeds, often within milliseconds or microseconds. The success of HFT strategies depends on minimizing latency—the time delay between when an order is sent and when it is executed.

The Role of Latency in HFT

In HFT, latency is a critical factor. Even the smallest delay can lead to missed opportunities or adverse price movements. Therefore, trading firms invest heavily in reducing latency through various means:

- Optimized Infrastructure: Low-latency trading networks rely on high-speed connections, often using advanced technologies such as fiber optics, microwave transmissions, and even millimeter-wave communications to minimize the time data takes to travel between trading systems and exchanges.

- Proximity to Exchanges: Many HFT firms collocate their servers within or near exchange data centers to reduce the physical distance that trading signals must travel, thereby minimizing latency.

- Hardware Acceleration: Specialized hardware, such as Field-Programmable Gate Arrays (FPGAs), is used to accelerate trading processes, reducing the time it takes to execute trades.

- Software Optimization: Every aspect of the trading software is optimized for speed, from the operating system’s networking stack to the execution algorithms.

FIX Protocol in HFT

The FIX protocol is designed to operate efficiently in these low-latency environments. Its message structure is optimized for speed, ensuring that orders are transmitted and executed as quickly as possible. In the context of HFT, the FIX protocol offers several advantages:

- Lightweight Messaging: FIX messages are designed to be compact and efficient, minimizing the amount of data that needs to be transmitted and processed.

- Deterministic Processing: FIX engines are often designed for deterministic behavior, ensuring that the time taken to process each message is predictable and consistent.

- Customizability: FIX allows for the customization of messages to suit specific trading strategies. Traders can create streamlined message sets that contain only the essential information, reducing processing time.

- Compatibility: FIX is widely adopted across the financial industry, ensuring compatibility between different trading systems and exchanges, which is crucial for the seamless operation of HFT strategies.

Dark Pools: The Hidden Liquidity Venues

Dark pools are private trading venues where large institutional investors can execute trades without revealing their intentions to the broader market. These pools allow participants to trade large blocks of securities anonymously, minimizing the market impact that such trades might have if executed on public exchanges.

The Importance of Dark Pools in HFT

Dark pools are particularly valuable in high-frequency trading for several reasons:

- Reduced Market Impact: HFT firms often trade large volumes, and executing these trades on public exchanges could significantly move the market. Dark pools allow these trades to be executed without revealing the order size, thereby reducing the potential impact on market prices.

- Access to Additional Liquidity: Dark pools offer access to liquidity that is not available on public exchanges, enabling HFT firms to execute trades more efficiently.

- Anonymity: The anonymity provided by dark pools allows HFT firms to keep their trading strategies concealed, preventing other market participants from identifying and exploiting their trading patterns.

FIX Protocol in Dark Pools

The FIX protocol plays a critical role in facilitating communication within dark pools. Its ability to transmit orders securely and anonymously is essential for maintaining the privacy and efficiency of dark pool operations. Here’s how FIX supports dark pools:

- Anonymous Order Routing: FIX messages can be configured to transmit only the necessary information, preserving the anonymity of the trading party. This feature is crucial in dark pools, where participants do not want to reveal their trading intentions.

- Complex Order Types: Dark pools often support complex order types, such as iceberg orders, which allow only a portion of the order to be visible to the market while hiding the larger part. FIX supports these advanced order types, enabling traders to execute their strategies effectively.

- Integration with Matching Engines: The matching engine in a dark pool is responsible for pairing buy and sell orders. FIX provides the communication framework between participants and the matching engine, ensuring that orders are matched quickly and accurately.

- Regulatory Compliance: Even though dark pools operate with a higher degree of privacy, they are still subject to regulatory oversight. FIX enables the transmission of regulatory reports, ensuring that dark pool operators comply with reporting requirements without compromising trade execution efficiency.

Low Latency Networks: The Backbone of Modern Trading

Low latency networks are the infrastructure that supports high-frequency trading and dark pool operations. These networks are designed to minimize the time it takes for data to travel between trading systems and exchanges, ensuring that orders are executed as quickly as possible.

Key Components of Low Latency Networks

Several factors contribute to the performance of low latency networks:

- Physical Connectivity: The choice of physical connections, such as fiber optics or microwave links, plays a significant role in determining the speed of data transmission. Microwave and millimeter-wave links, while more expensive, offer significantly lower latency than traditional fiber optics.

- Geographical Proximity: Trading firms often collocate their servers near exchange data centers to reduce latency. The closer the servers are to the exchange, the less time it takes for data to travel between them.

- Network Optimization: Low latency networks are optimized for speed through techniques such as routing optimization, packet prioritization, and the use of dedicated lines. These strategies help ensure that trading data travels the shortest and fastest path between points.

- Software Efficiency: The software running on these networks, including the FIX engines, is optimized to handle data as quickly as possible, minimizing the time taken to process and transmit trading messages.

FIX Protocol and Low Latency Networks

The FIX protocol is designed to operate efficiently within low latency networks. Its lightweight message structure, combined with the optimizations in the network infrastructure, ensures that trading data is transmitted and processed with minimal delay.

- Message Prioritization: In low latency networks, FIX messages can be prioritized to ensure that critical trading data is transmitted as quickly as possible. This prioritization is essential in high-frequency trading, where delays can lead to missed opportunities.

- Asynchronous Processing: FIX engines often support asynchronous processing, allowing multiple operations to occur simultaneously. This capability further reduces latency by enabling faster message handling and execution.

- Optimized Parsing: FIX engines are optimized to parse messages quickly, minimizing the time taken to interpret and act on trading instructions.

Hardware Requirements for Low-Latency Trading

Achieving low latency in a high-frequency trading environment requires more than just optimized software protocols like FIX. It also necessitates state-of-the-art hardware designed to minimize delays at every stage of the trade process. Below are some key components typically found in HFT setups:

- Network Interface Cards (NICs): Specialized low-latency NICs are crucial for reducing the time it takes for data to travel between the server and the network. These NICs often come with features like kernel bypass and direct memory access (DMA), which allow data to be processed without the overhead of the operating system, reducing latency.

- Field-Programmable Gate Arrays (FPGAs): FPGAs are hardware components that can be programmed to perform specific tasks at high speed. In HFT, FPGAs are often used to accelerate data processing, allowing trades to be executed in microseconds. They can be integrated into NICs or used as standalone devices to handle tasks such as order book management or risk checks.

- High-Performance Servers: The servers used in HFT environments are typically custom-built for speed and reliability. These servers often have high-frequency CPUs with multiple cores, large amounts of RAM, and fast storage solutions like NVMe SSDs. The goal is to ensure that trade orders are processed as quickly as possible.

- Direct Market Access (DMA) Routers: DMA routers allow trading firms to connect directly to the exchange's order book, bypassing intermediaries and reducing latency. These routers are often located in the same data centers as the exchanges, further minimizing the distance that data needs to travel.

- Optical Fiber Cables: The physical medium through which data travels can also impact latency. In many HFT setups, firms use optical fiber cables to ensure that data transmission is as fast as possible. In some cases, firms even invest in shorter, more direct routes between data centers to shave milliseconds off their transaction times.

- Microwave and Millimeter Wave Links: For the absolute lowest latency, some trading firms have turned to microwave and millimeter wave technology. These technologies allow data to be transmitted through the air rather than through fiber optic cables, reducing latency by a fraction of a millisecond, which can be significant in HFT.

Challenges and Considerations

While the combination of FIX protocol, dark pools, high-frequency trading, and low latency networks offers significant advantages, it also presents several challenges:

- Complexity: Implementing and maintaining a trading system that operates in this environment is highly complex. Firms must invest in specialized knowledge, advanced technology, and continuous optimization to stay competitive.

- Security: The speed and anonymity provided by low latency networks and dark pools can be exploited for malicious purposes. Ensuring the security of trading systems and protecting against cyber threats is an ongoing challenge.

- Regulatory Compliance: Dark pools and high-frequency trading practices are subject to increasing regulatory scrutiny. Navigating the complex and evolving landscape of regulations requires significant resources and expertise.

- Market Fragmentation: While dark pools offer privacy and reduced market impact, they also contribute to the fragmentation of liquidity. This fragmentation can reduce market transparency and impact the overall efficiency of price discovery.

Future Trends

The future of FIX protocol in dark pools, high-frequency trading, and low latency networks will likely be influenced by several emerging trends:

- Artificial Intelligence and Machine Learning: AI and machine learning are increasingly being integrated into trading systems, enhancing the capabilities of FIX-based systems by optimizing order routing, predicting market movements, and reducing latency.

- Blockchain and Distributed Ledger Technology (DLT): Blockchain and DLT have the potential to revolutionize trade settlement and clearing processes. These technologies could eventually be integrated with FIX to provide faster and more secure trade execution.

- Regulatory Evolution: As regulators continue to scrutinize dark pools and high-frequency trading, new rules and guidelines will emerge. These developments will influence how FIX is used, particularly in terms of transparency, reporting, and market surveillance.

- Advances in Networking Technology: Ongoing advancements in networking technology, such as the development of 5G and beyond, will further reduce latency and improve the performance of FIX-based systems. These innovations will enable even faster trading and more sophisticated strategies.

Conclusion

The FIX protocol, when combined with low-latency networks and cutting-edge hardware, is a powerful tool in the arsenal of high-frequency trading firms operating in dark pools. By enabling fast, anonymous, and reliable trade execution, it allows firms to stay ahead of the competition in a market where milliseconds can mean the difference between profit and loss.

As the financial markets continue to evolve, the importance of the FIX protocol in dark pool HFT environments will only grow. Firms that invest in the right hardware and network infrastructure, and that fully leverage the capabilities of the FIX protocol, will be well-positioned to thrive in this fast-paced and competitive landscape.

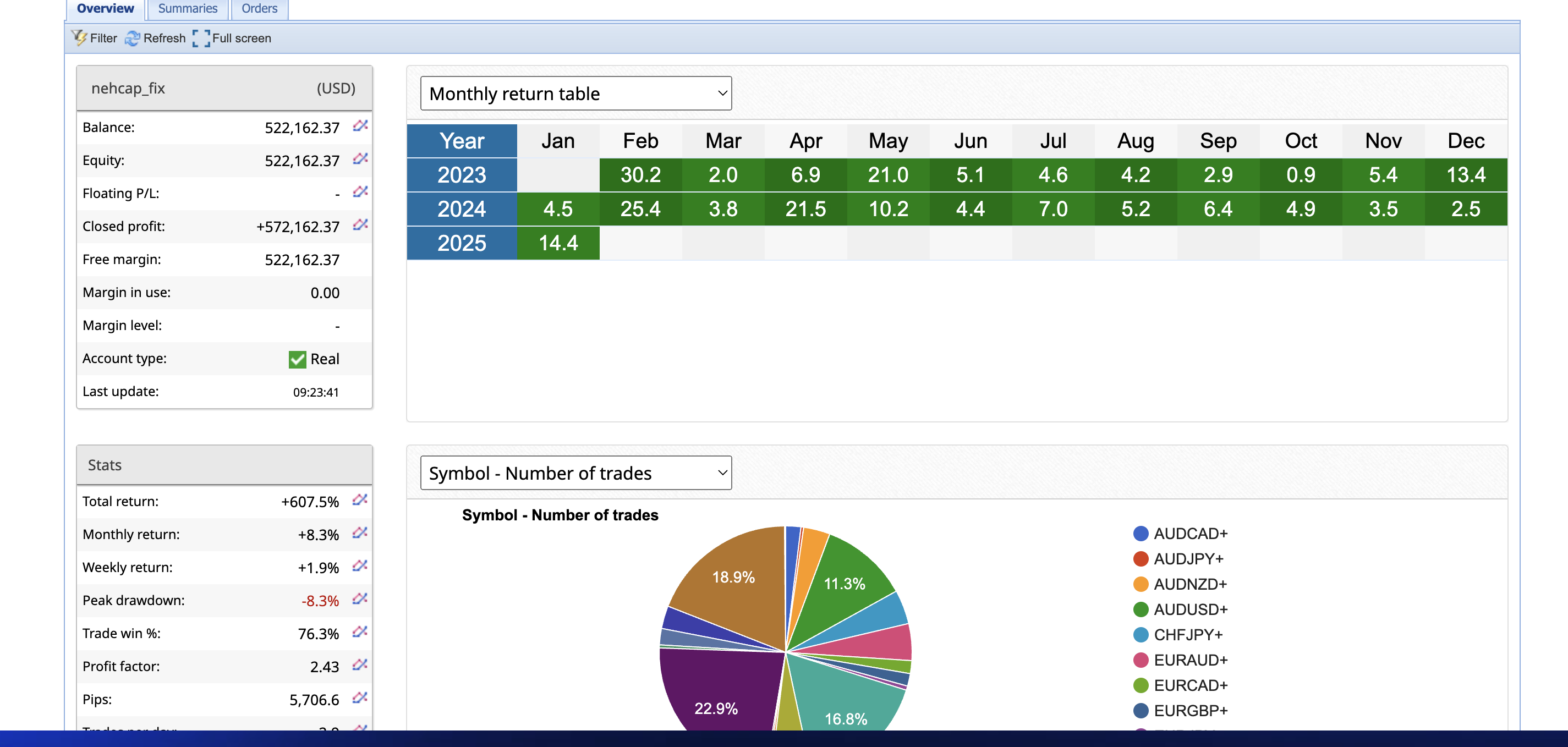

Nehcap provides the leading HFT system with remarkable history of profitability. The system runs live with over 670k capital (Withdrawal of 150k) so current equity is at 520k.

Check the live account of our HFT on our live account: https://www.fxblue.com/users/nehcap_fix

To acquire the PIN, simply email us at support@nehcap.com

The LIVE account performance is shown below. Monthly performance in % terms.

The current month has made +14% return already

If you wish to start our HFT machine on your account, this is different from you put normal ea, you need to follow the below procedure.

Step 1: Please open a FIX based account from below at either of them. PFD is a free broker while VARIANSE Is a paid broker for offering its PRIME-XM account which is highly recommended for HFT systems. You can open an account at either broker below.

- OPEN A NEW LIVE CCOUNT at Pacific Financial Derivatives

- OPEN A NEW ACCOUNT at Varianse Broker (UK regulated) (Highest tickdensity)

Step 2: Deposit the funds you want to trade.

Step 3: Submit your FIX details via email support@nehcap.com or telegram @mqlnehcap

Step 4: Trading commences after client submits risk parameters like lot sizes and so on.