High-Frequency Trading (HFT): Evolution, Impact, and Market Dynamics

High-frequency trading (HFT), a cornerstone of modern electronic markets, leverages advanced algorithms, ultra-low-latency infrastructure, and direct exchange colocation to execute millions of trades within milliseconds. Predominantly utilized by institutional investors, hedge funds, and investment banks, HFT has reshaped market structure since its rise post-2005, when SEC reforms like Regulation NMS dismantled centralized exchanges, fostering cross-market arbitrage and electronic trading.

Core Mechanics and Market Access

HFT algorithms analyze vast datasets to identify fleeting arbitrage opportunities across global exchanges. By colocating servers within exchange data centers, HFT firms gain microsecond advantages in price discovery—a privilege costing millions annually, yet accessible to any entity willing to invest. Critics argue this creates an uneven playing field for retail investors, though exchanges mandate regulated, equitable access.

Controversies and Criticisms

Scrutiny intensified after Michael Lewis’s Flash Boys (2015) and the 2010 Flash Crash, where the Dow plummeted 1,010 points intraday. Critics blamed HFT for exacerbating volatility and offering “ghost liquidity”—transient order books that vanish under stress. However, proponents, including former SEC deputy director Scott Bauguess, counter that HFT tightens bid-ask spreads, lowering costs for all investors.

Regulatory and Strategic Shifts

SEC Chair Gary Gensler’s focus on payment-for-order-flow (PFOF) and market transparency echoes past debates around HFT’s fairness. Meanwhile, the industry has evolved: once-niche firms like Citadel and Jump now dominate as liquidity providers, expanding into FX, ETFs, and commodities. Consolidation has thinned competition, with surviving players prioritizing data analytics and global reach over mere speed.

Future Trajectories

As latency edges toward physical limits, firms pivot to predictive analytics and emerging markets (Asia-Pacific, Brazil). Transaction Network Services’ Jeff Mezger notes a shift from “speed arms races” to democratized access, enabling smaller players to compete. Yet, unresolved questions linger around market structure experiments, like the halted SEC Transaction Fee Pilot, leaving regulators and investors to weigh HFT’s net benefits against its complexities.

In essence, HFT remains a dual-edged sword: a driver of efficiency and liquidity, yet a perennial subject of debate in the pursuit of equitable markets.

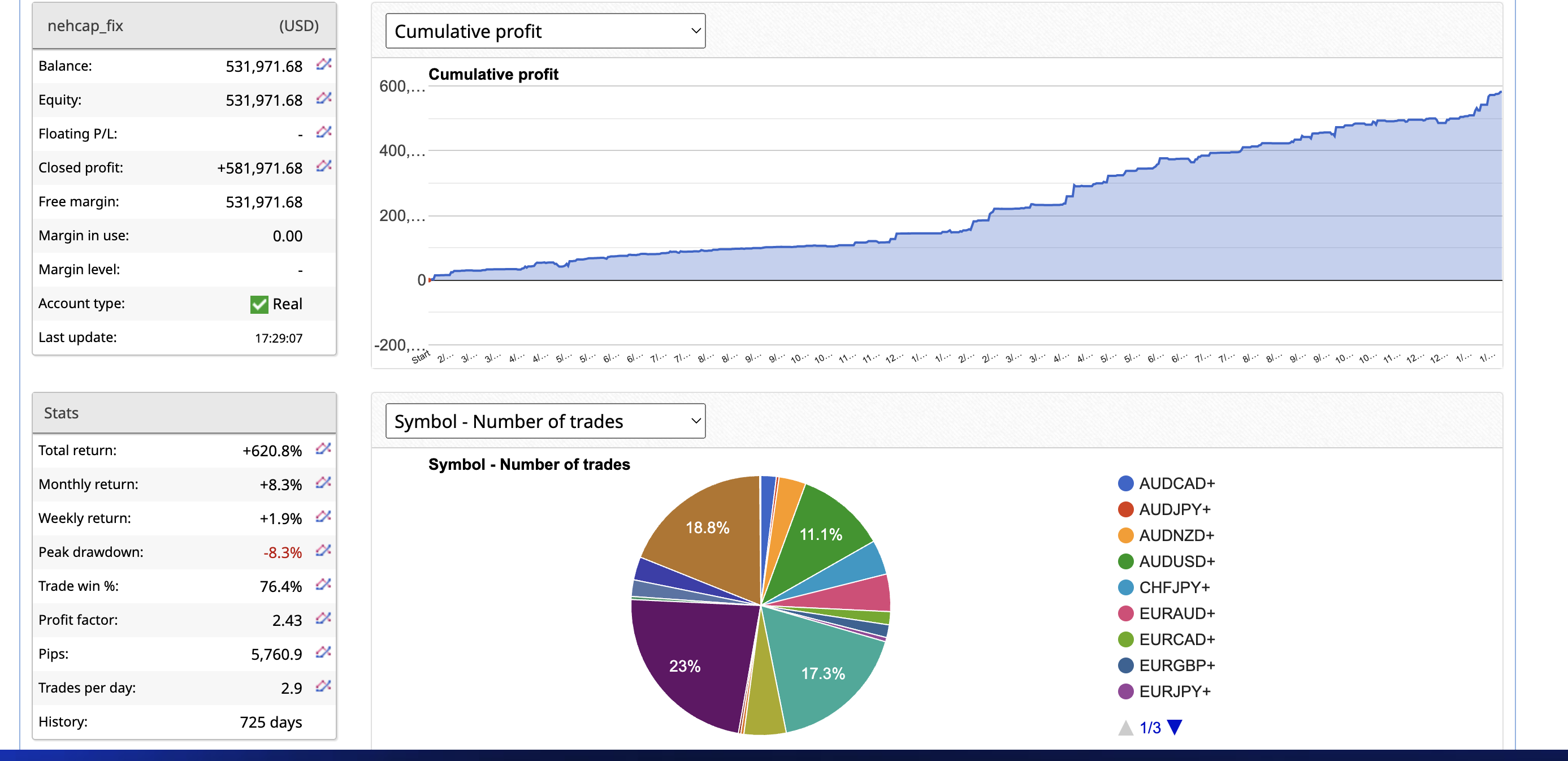

NEHCAP.COM runs the most sustained and long term profitable HFT system amongst retail The infra required is taken care by our team while the algorithm which closely mimics fast paced entry and exit from a trader often during the same micro second. The trades are sent to the FIX login of the client.

Here is the latest perfomance.

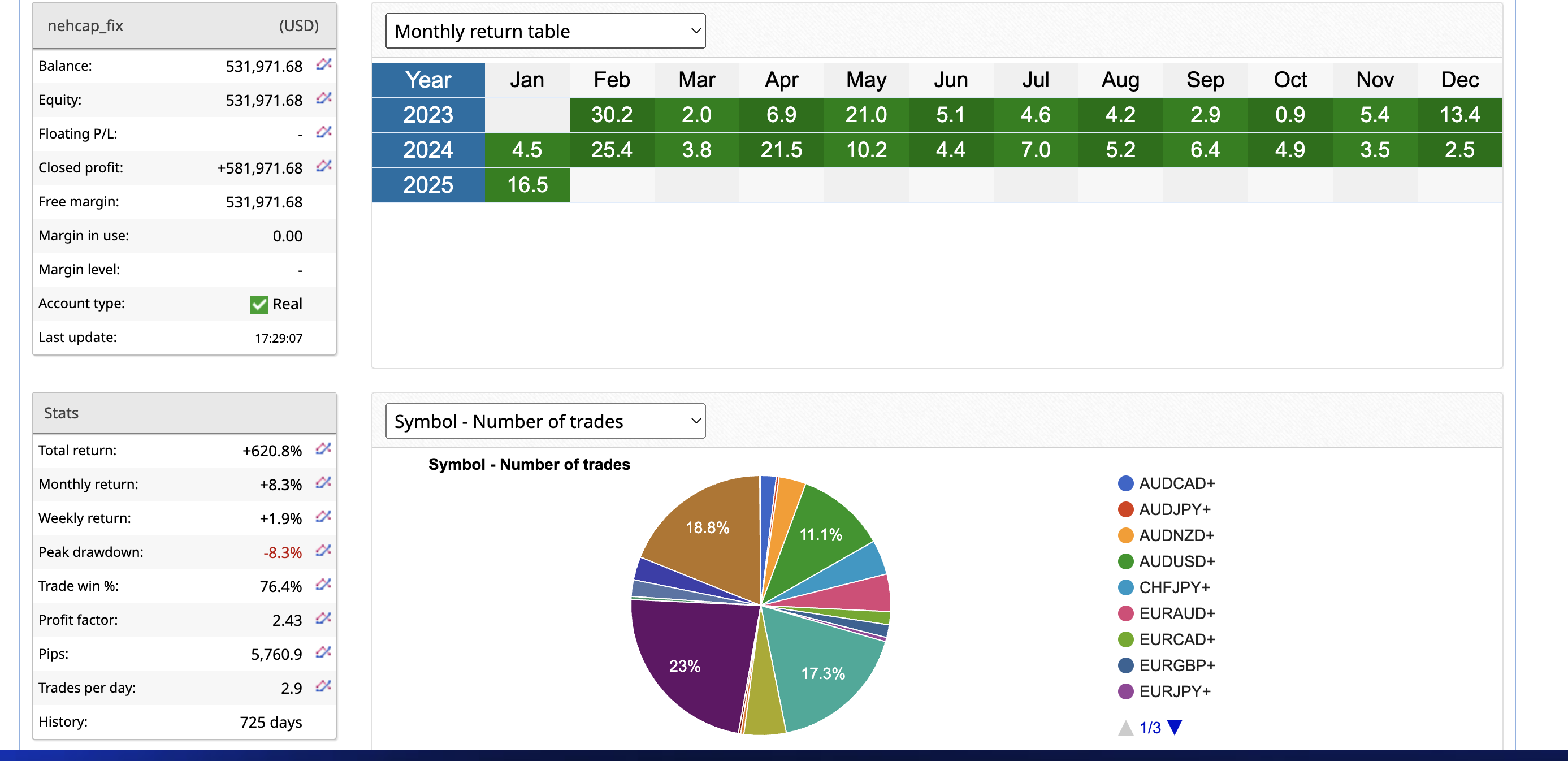

Monthly equity performance

The equity curve shows the system loses very little but when it wins, it wins big. As seen above max dd was only +8% back in 2023. HFT_FIX is a system that executes high frequency trades at key data hours.

Our system pricing can be seen here: pricing

About us:

We have launched 3 different systems since last March 2023. Each of the systems are running live with 100k on each of the account. Our investors and clients can totally rely on us to make money knowing the system creators run their capital. Our systems are deeply tested.

How to Start HFT_FIX

Step 1: Please open an account from two suggested broker. These two brokers are suited for FIX based HFT trading. You can choose either. Brokers must support FOK orders on their FIX platform for the High Frequency Trading from us.

Step 2: Deposit the funds you want to trade.

Step 3: Contact us via email support@nehcap.com or telegram @mqlnehcap

- Chat with us at telegram : Join the NEHCAP GROUP

To purchase: Contact us via email or telegram : @mqlnehcap

- Chat with us at telegram : Join the NEHCAP GROUP