In the dynamic world of forex trading, traders have an array of strategies at their disposal to navigate the ever-changing currency markets. Each strategy comes with its unique principles and methodologies, catering to diverse trading styles and risk appetites. Let's delve into some prominent forex trading strategies:

- High-Frequency Trading (HFT): HFT involves using powerful computer algorithms to execute a large number of trades at lightning speed. Traders employing this strategy aim to profit from tiny price discrepancies and market inefficiencies that occur within microseconds. HFT requires advanced technology, low latency connectivity, and substantial capital, making it suitable for institutional investors and sophisticated traders.

- Trend Trading: One of the most popular approaches in forex, trend trading involves identifying and following the prevailing market trends. Traders seek to enter positions in the direction of a well-established trend, aiming to ride the momentum until signs of a trend reversal emerge. Technical indicators and chart patterns are often used to spot potential trends and confirm their strength before entering trades.

- Counter Trend Trading: In contrast to trend trading, counter trend trading seeks to capitalize on price reversals or corrections. Traders using this strategy aim to enter positions against the prevailing trend, betting on temporary price movements that go against the overall market direction. Counter trend trading requires precise timing and careful risk management, as it goes against the prevailing market sentiment.

- Fundamental Analysis: Unlike purely technical strategies, fundamental analysis focuses on macroeconomic and geopolitical factors that impact currency values. Traders employing this strategy study economic indicators, interest rates, geopolitical events, and central bank policies to gauge a currency's intrinsic value. By understanding the underlying fundamentals, traders can make informed long-term predictions and position themselves accordingly.

- Carry Trade: The carry trade strategy involves borrowing funds in a currency with low-interest rates and investing in a currency with higher interest rates. The goal is to earn the interest rate differential between the two currencies while holding the position open. Carry trades are often done with high leverage and require careful risk management due to potential currency fluctuations.

- Range Trading: Range trading seeks to profit from price movements within defined support and resistance levels. Traders using this strategy identify currency pairs that are trading within a specific price range and aim to buy at support and sell at resistance. This strategy is well-suited for stable market conditions but requires patience and discipline to avoid false breakouts.

In conclusion, the forex market offers a diverse range of trading strategies, catering to various trading styles and risk appetites. Whether you prefer fast-paced high-frequency trading, trend following, counter trend trading, fundamental analysis, carry trades, or range trading, understanding the underlying principles and employing sound risk management is key to successful forex trading. Each strategy has its merits and drawbacks, and the most effective approach will depend on individual preferences and market conditions. Happy trading!

About nehcap

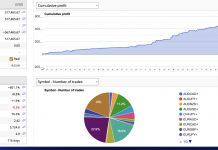

Nehcap is a forex retail investment firm which specialises in generating returns through clearly defined edge. We have two stellar products for traders:

- EA_FIX : A HFT system that is powering our 100k live account. Read here

- EA_GROWTH: A MT4 trend system that is running on our live account of over 100k. This system is suitable for all who are using MT4. Read details

Both systems are available for purchase by indicating interest : Contact Us