In the financial industry, FIX (Financial Information eXchange) protocol is widely used to facilitate the electronic communication of trade-related information. FIX protocol version 4.4 (FIX 4.4) is one of the most commonly used versions. It defines various types of orders that traders can use to execute trades on different financial instruments. Here are some common order types in FIX 4.4:

- Market Order (OrdType = 1): A market order is an instruction to buy or sell a financial instrument at the best available price in the market. It is executed immediately at the current market price, irrespective of the price level. The trader does not specify a price for a market order.

- Limit Order (OrdType = 2): A limit order is an instruction to buy or sell a financial instrument at a specified price or better. It will only be executed at the specified price or a more favorable price. If the specified price is not available in the market, the order remains open until it can be executed at the desired price.

- Stop Order (OrdType = 3): A stop order, also known as a stop-loss order, is an instruction to buy or sell a financial instrument once its price reaches a specified stop price. When the stop price is reached, the stop order becomes a market order, and the trade is executed at the best available price.

- Stop Limit Order (OrdType = 4): A stop-limit order combines features of a stop order and a limit order. It consists of two specified prices: the stop price and the limit price. When the stop price is reached, the stop-limit order becomes a limit order, and the trade is executed at the limit price or better.

- Immediate or Cancel (IOC) (TimeInForce = 3): An IOC order is an instruction to execute the order immediately in part or in whole. If the order cannot be filled immediately, the unfilled portion is canceled. The objective is to fill as much of the order as possible without any remaining quantity.

- Fill or Kill (FOK) (TimeInForce = 4): A FOK order is an instruction to execute the order immediately and entirely. If the order cannot be completely filled immediately, it is canceled, and no partial execution is allowed.

- Good Till Cancel (GTC) (TimeInForce = 1): A GTC order remains active in the market until the trader explicitly cancels it. It will persist until it is executed or canceled, making it a long-term order type.

- Good Till Date (GTD) (TimeInForce = 6): A GTD order remains active until a specified date and time. If the order is not executed before the specified date, it is automatically canceled.

These are some of the commonly used order types in FIX 4.4. Traders can use these order types based on their specific trading strategies and risk management preferences. It’s essential for traders and developers working with FIX protocol to understand the nuances of each order type to ensure accurate and efficient trade execution.

Nehcap HFT system uses IOC orders above within the limit orders. It uses market order for close trades. The EA_FIX provides a HFT which retail traders can take advantage. This is the only authentic true FIX trading system on internet for retail clients. It bypasses MT4 totally and hence is not exposed to wide slippages that clients have to suffer at the hands of Metatrader systems.

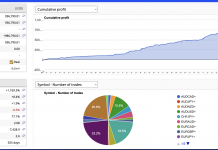

Performance of our brilliant EA_FIX. Our live account has made +88.2% return in the space of 7 months and continues to ride higher. The 100k account has hit 188.23k. Check out fxblue live link